Featured

- Get link

- X

- Other Apps

Examples Of Automatic Stabilisers

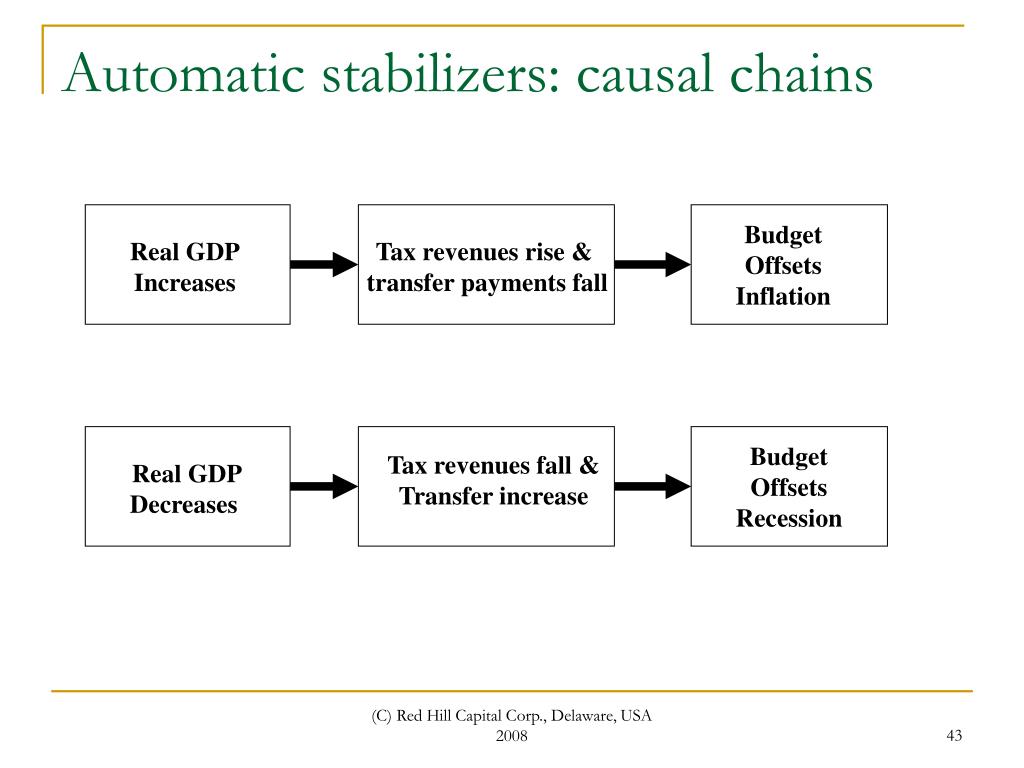

Examples Of Automatic Stabilisers. Automatic stabilizers are mechanisms built into government budgets, without any vote from legislators, that increase spending or decrease taxes when the economy slows. A common example of automatic stabilizers is corporate and personal income taxes that are progressively graduated, which means that they are fixed in proportion to the income levels of.

The analysis found, for example, that stabilizers increased the deficit by 32.9% in. Automatic stabilizers are a part of the structure of the economy that work to limit the expansions and contractions of the business cycle over what they would be otherwise. A fall in tax revenues from the circular flow during a.

Automatic Stabiliser Government Spending And Taxation That Automatically Change To Reduce Variations In Economic Activity.

An automatic stabilizer definition is a fiscal measure embedded into the government’s budget that demands more public spending and lower taxes to sustain the economy automatically during the recession.; Automatic stabilizers are changes in fiscal policy that stimulate aggregate demand when the economy goes into a recession but that occur without policymakers having. Which of these are examples of automatic stabilizers?

In Macroeconomics, Automatic Stabilizers Are Features Of The Structure Of Modern Government Budgets,.

The automatic stabilizer is a system in which when the economy is fluctuating. A common example of automatic stabilizers is corporate and personal income taxes that are progressively graduated, which means that they are fixed in proportion to the income levels of. During periods of rapid economic growth (a boom phase) tax revenues will rise as household real incomes and.

The Most Common Examples Of Automatic Stabilizers Include Progressive Tax Codes And Government Programs.

For example, the government may implement this type of fiscal policy during an economic crisis to increase aggregate demand. It proposes a progressive or flexible taxation framework and transfers payments to rapidly stabilize income, consumption, and corporate expenditure levels and encourage. Sales tax revenues and income security b.… a:

The Most Prominent Examples Of Automatic Stabilizers Are (A) Personal And Business Taxes And (B) Social Security Expenses Such As Unemployment Insurance.

Spending on these programs decreases during a prosperous economy and increases during a downturn. If the economy is booming, these measures. Automatic stabilizers are stop gaps built into our nation’s fiscal policy that immediately engage the moment a swing in the business cycle becomes threatening.

A Fall In Tax Revenues From The Circular Flow During A.

The analysis found, for example, that stabilizers increased the deficit by 32.9% in. On the other hand, if the government runs a contractionary fiscal policy, this. Progressively increasing corporate income taxes gradually increasing personal income taxes unemployment insurance collected.

Popular Posts

An Example Of A Two Point Violation Includes Reckless Driving

- Get link

- X

- Other Apps

Comments

Post a Comment